Gotta give her credit.

A Texas woman claims she got herself out of $70,000 in debt — and is on her way to making $1 million by teaching others how to do the same.

Jasmine Taylor, 31, from Amarillo, said she lost her job and struggled to make ends meet in early 2021, buried under $60,000 in student loans and another $9,000 in medical and credit card debt.

That’s when she discovered “cash stuffing” on social media, a money-management practice where you put your debit and credit cards away and place all your cash into designated envelopes for rent, groceries, shopping, etc.

“I put aside money for bills in envelopes. I put money aside for variable expenses, which is weekly spending,” she told CNBC of her monthly process.

She continued: “Then you also put money aside for ‘sinking funds,’ which are like little short-term or long-term savings accounts,” which can include a rainy-day fund, vacation money, or a little extra cash for the holidays.

“It was life-changing for me. I was not managing my money. I needed to take accountability for my previous financial mistakes,” Taylor said on “Good Morning America.”

Taylor quickly realized she was spending more money than she traditionally budgeted for — when she saw the dollar bills diminishing.

“I went from swiping a credit card and not really understanding where my money was going to having to tangibly handle the cash. There’s this money that’s unaccounted for that I was wasting frivolously, impulsively spending,” she explained.

“When you add it all up at the end of the month, it’s $400 or $500, and I’m wondering why I’m struggling to pay certain bills or struggling to make it to the next check.”

Taylor claimed to CNBC that she saved $1,000 in her first year of cash stuffing and had paid $32,000 of her debt off by the end of the first year.

“It’s a really surreal feeling when you’re a person who has mismanaged money all their life, when you finally get to the point where it’s like, ‘OK, I can do this,”‘ she told the outlet.

Successfully managing her own bank account, Taylor started sharing her process on TikTok.

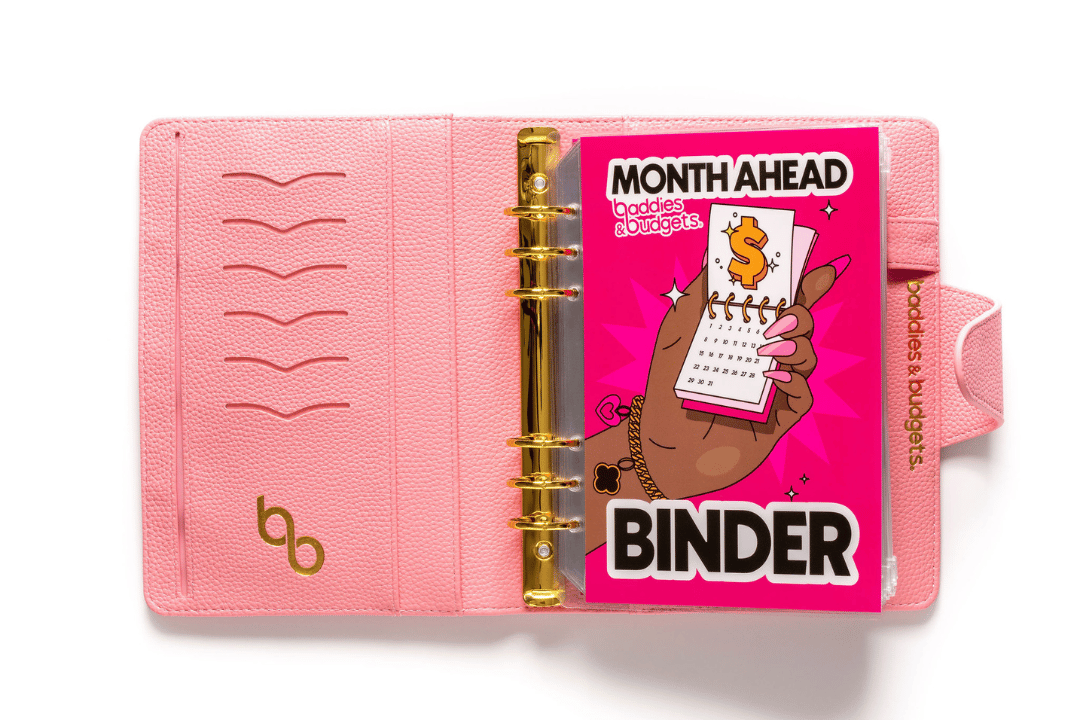

She said she then used her $1,200 stimulus check from the COVID-19 pandemic to launch Baddies and Budgets: Her own line of budget binders, planners, labeled envelopes, and spending trackers.

Her business reportedly netted $850,000 last year and is projected to take in $1 million by the end of 2023.

“The same stuff I teach my audience, I still use in my everyday life,” Taylor told CNBC, claiming she also gives herself a weekly salary of $1,200 and reinvests the rest into the business.

While Taylor and her techniques have been introduced to a new generation on TikTok, envelope stuffing has been around for decades.

“I’ve had older women reach out. They come across my content, and they’re like, ‘My grandmother used to do that!’” Taylor said.