Struggling to make ends meet, babe? You're not alone. We feel you. The struggle is real, and it's about time you took control of your financial situation. Buckle up because we're about to dive into the ultimate beginner's guide to budgeting and help you create a bomb-ass budget that works for you – even if those dollar bills are a little too scarce. Say goodbye to the stress, babes, because we're about to serve up some major money management magic.

1. Track those Benjamins:

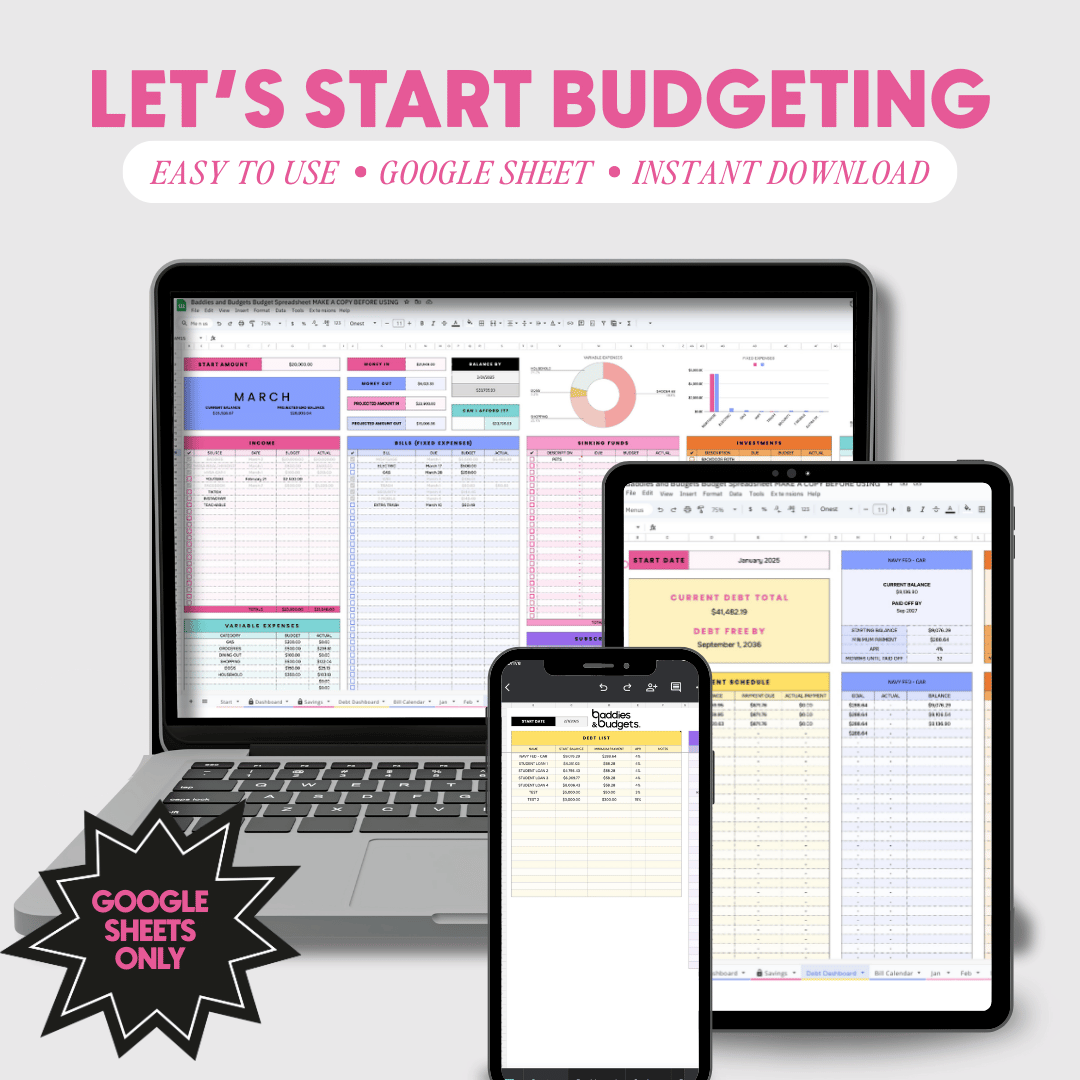

Listen up, baddie – before we can start budgeting, you need to know where that cash is flying out of your hands like it's on a first-class jet to paradise. Keep track of every single penny, from the tall lattes to those impulse buys on your favorite shopping app. Grab a notebook or a snazzy budgeting app and get to work. Once you've got all the deets on your spending pattern, break it down into two categories: essentials and non-essentials. You're a boss, and you're about to show your money who's in charge.

2. Prioritize like a Queen:

Now that you know where your hard-earned cash is going, it's time to focus on the essentials, babe. We're talking about the roof over your head, the lights that keep your palace shining, the food on your plate, that whip that gets you where you need to go, and of course, your health. Make sure you've got enough moolah set aside for these must-haves. And if your income just ain't cutting it, don't worry – we've got your back. Look into assistance programs or get creative with ways to cut those costs. With a little hustle, anything is possible.

3. Set Goals and Slay:

You've covered the basics, babe, now it's time to get real – those non-essential expenses. We're talking entertainment, dining out like a queen, and hitting the mall for a little retail therapy. But hold up, queen bee – you gotta be realistic about what you can actually afford. Don't be afraid to make adjustments, tighten those purse strings, and find alternatives that won't break the bank. Girl, you've got dreams, and you gotta prioritize your financial future while still pampering yourself along the way. Balance is key, babe.

4. Save That Cash, Honey:

Listen up, baddie – we know it might seem impossible, but we're about to drop some wisdom on you: saving is non-negotiable. Yup, you heard that right. No matter the size of your paycheck, include a savings goal in that fabulous budget of yours. Whether it's for emergencies, investing in your future, or creating a cushion for those unexpected expenses, savings are your secret weapon to financial freedom. You're a money-saving queen in the making.

5. Stay on Top, Boss Babe:

Your budget ain't no one-time thing, babe. It's a living, breathing tool that needs TLC on the regular. Keep that budget in check by revisiting it often, tweaking where needed, and staying aligned with your financial goals. Life changes, priorities shift, and you deserve to be in the driver's seat when it comes to your money. Keep slaying, babes – you're on the path to financial greatness.

Conclusion:

Creating a budget may feel like a leap into the unknown, babe, but trust us, it's your first step towards becoming the financial badass you were born to be. It takes some time and effort, but once you've got your budget game on lock, you'll be strutting towards financial stability like the queen you truly are. So go ahead, unleash your inner boss babe, and start taking control of your finances. Your future is looking brighter than ever before. Let's slay this budgeting game, together. 💁♀️💰