Emergency Funds 101: How Much Should You Really Save?

Blog Summary: How much should your emergency fund really be? This blog post breaks it down step-by-step so you can feel secure and stay recession-proof.

Step 1: Know Your Monthly Must-Haves

Add up essentials: rent/mortgage, food, gas, insurance, meds, childcare. This is your baseline monthly expense.

Step 2: Multiply That Number by 3–6

Three months is the minimum. Six is ideal. If you're a business owner or have variable income, aim for 9–12.

Step 3: Park It Where It’s Safe

High-yield savings accounts are your friend. Keep your emergency fund separate so you’re not tempted to dip into it.

Step 4: Build It Bit by Bit

Start with $500, then $1,000. Automate a small amount from every check until you reach your goal.

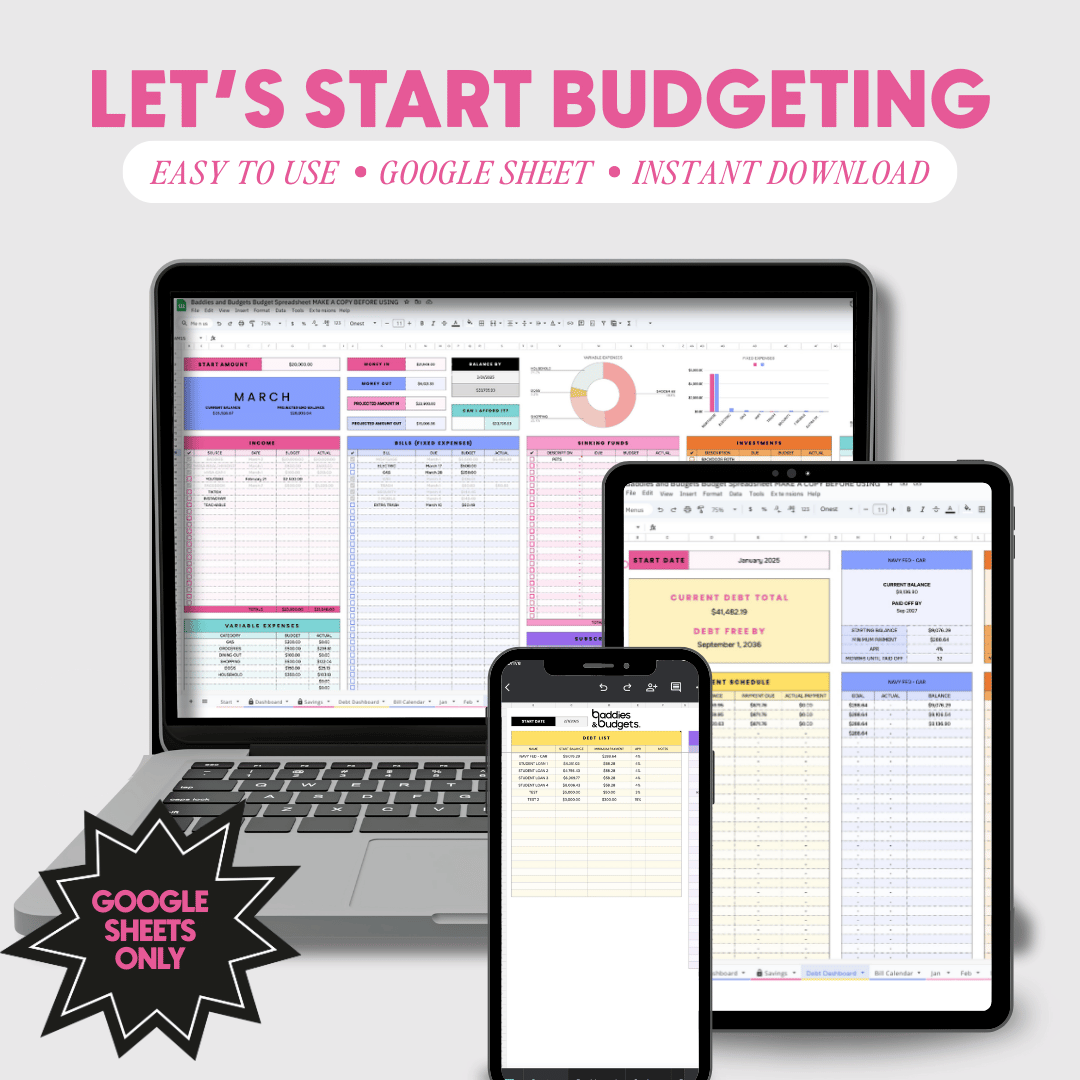

✨ Shop the Baddie Tools You Need ✨

52 Fridays Savings Binder

Your weekly challenge to stack $1,378 in a year—one Friday at a time. 💵

Shop Now

100 Envelope Challenge

A baddie classic. Save $5,050 with this iconic challenge—includes envelopes and a binder!

Shop Now

Intentionally Rich® Budget Planner

Plan your glow-up, track your goals, and build wealth with intention in 2025. ✨

Shop Now